There are many pieces of folk wisdom that get passed around when you’re shopping for car insurance. Tips like red cars get charged higher premiums than neutral-colored cars, or trying to register your vehicle in a different state than where you live get passed around frequently.

However, one of the most prevalent pieces of wisdom we’ve seen is that car insurance for men is more expensive than car insurance for women. But does that hold up in data?

Insurance premiums are based on how much risk a carrier takes on by insuring you.

A driver with more tickets who lives in an area with a greater incidence of theft means a greater likelihood that their carrier has to pay out insurance claims, leading to a higher premium for that driver. Looking at the data for male vs. female driver fatalities, we can see some of the foundations for the idea that men pay more for insurance than women. - From 1975 to 2020, nearly every year, more than twice as many men than women died in traffic fatalities, even as the rate of fatal accidents decreased overall.

- In 2020 men involved in these crashes were also 10% more likely than women to be speeding or driving with a Blood Alcohol Content (BAC) above the legal limit.

But who actually pays more for car insurance?

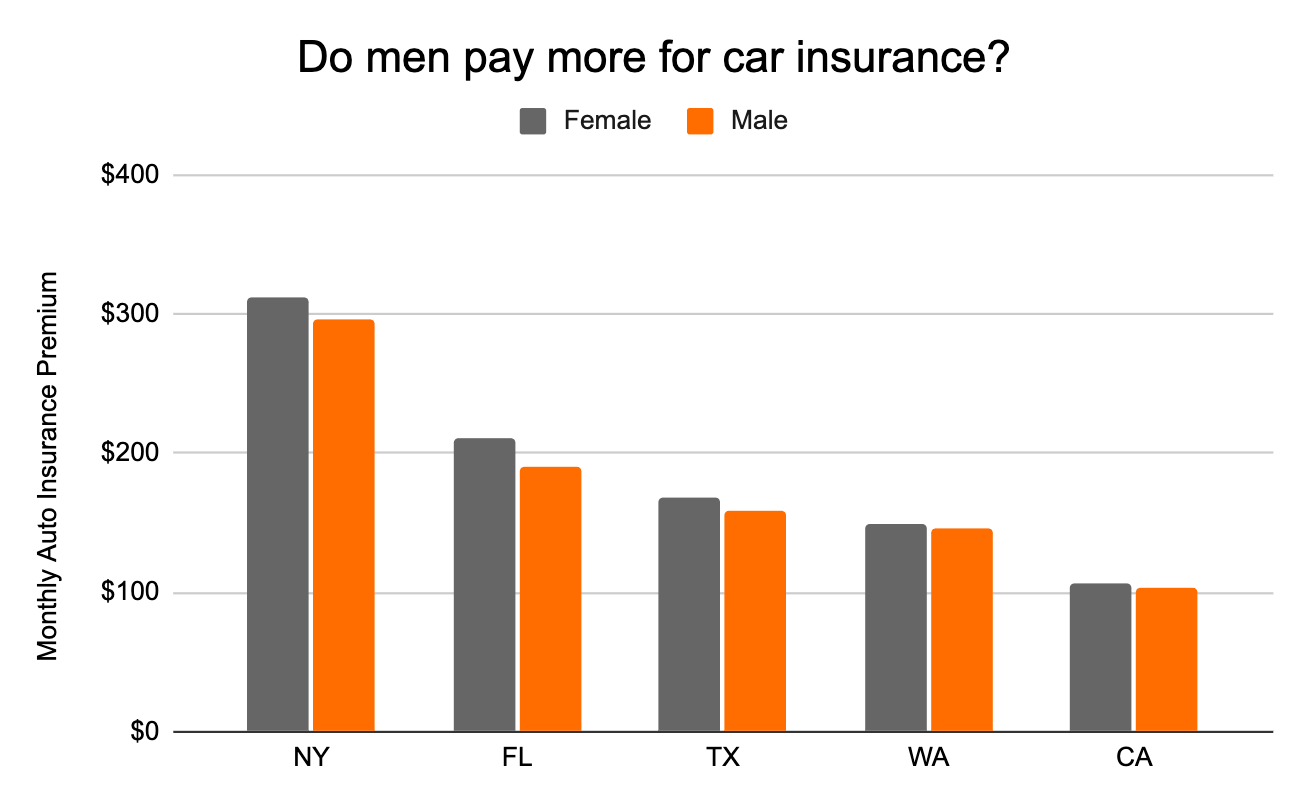

Coverage Cat generated over 50,000 car insurance quotes for drivers in five states (CA, FL, NY, TX, and WA) and found that women pay more for car insurance, with female drivers in New York and Florida displaying the most significant gender disparities in their monthly premiums.

The median monthly premium for a New York female driver was $15.91 more than a New York male driver, while the median monthly premium for a Florida female driver was $20.67 more than a Florida male driver. That’s $190.92 more per year for the New York driver and $247.99 more per year for the Florida driver.

In this case, we see that conventional wisdom regarding which gender pays more for car insurance doesn’t play out in any state.

Women spend more on insurance premiums than men in FL, NY, TX, and WA. In California, however, our results show near parity, which reflects a 2019 ban on using gender to price insurance. While we can’t know the exact reason for the results in the remaining four states, one thing is clear. It’s time to start questioning conventional wisdom around insurance buying and start delving into the data.

Ready to buy car insurance based on more than rumors? Try Coverage Cat to optimize your insurance buying process for home, auto, and umbrella policies.