Insurance for Doctors - What Types of Insurance Should Physicians Buy

Malpractice insurance, health insurance, disability insurance, and even life insurance are hot topics in the medical field - but what about other risks?

Malpractice insurance, health insurance, disability insurance, and even life insurance are hot topics in the medical field - but what about other risks?

Driving during the first few weeks of the DST time change isn't fun - and it's dangerous. Make sure you're protected!

Reddit is a great place to go for recs, but sometimes their car insurance advice goes off the rails.

On August 1, 2023, all New York State drivers got an unexpected addition to their policy. Is it necessary?

Remember web rings from 1998? This is the 2023 version.

Texas drivers are feeling the sting of rising car insurance rates, even without accidents or claims. To help ease the pain, check out Coverage Cat’s top tips for shopping around and saving money.

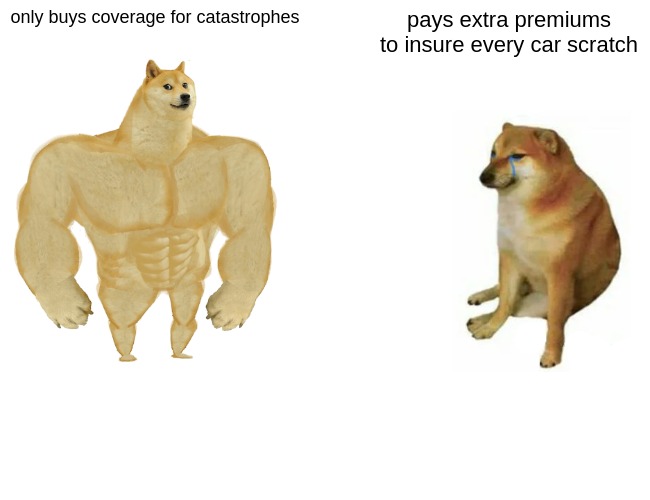

The capacity to self-insure, and effectively turn wealth into more wealth, is the main way that the rich leverage their insurance advantage.

Stop wondering how much insurance should cost or how much to buy. Coverage Cat's Price and Coverage Calculator lets you understand your prices with real insurance data.

House hacking can be the perfect way to increase your income and get closer to financial independence, but it makes buying insurance trickier.

Your lines of credit can enable you to save money on insurance

If higher homeowners insurance prices have you second-guessing your coverage, figure out what you actually need before cutting back!

Young drivers get charged more for car insurance, but many people believe that changes once you turn 25. Does turning 25 equal big savings, or is this just another insurance myth?

The problem with buying insurance the way is that prices are hidden, which costs you a lot of time and money. Coverage Cat is changing that with price transparency tools and data.

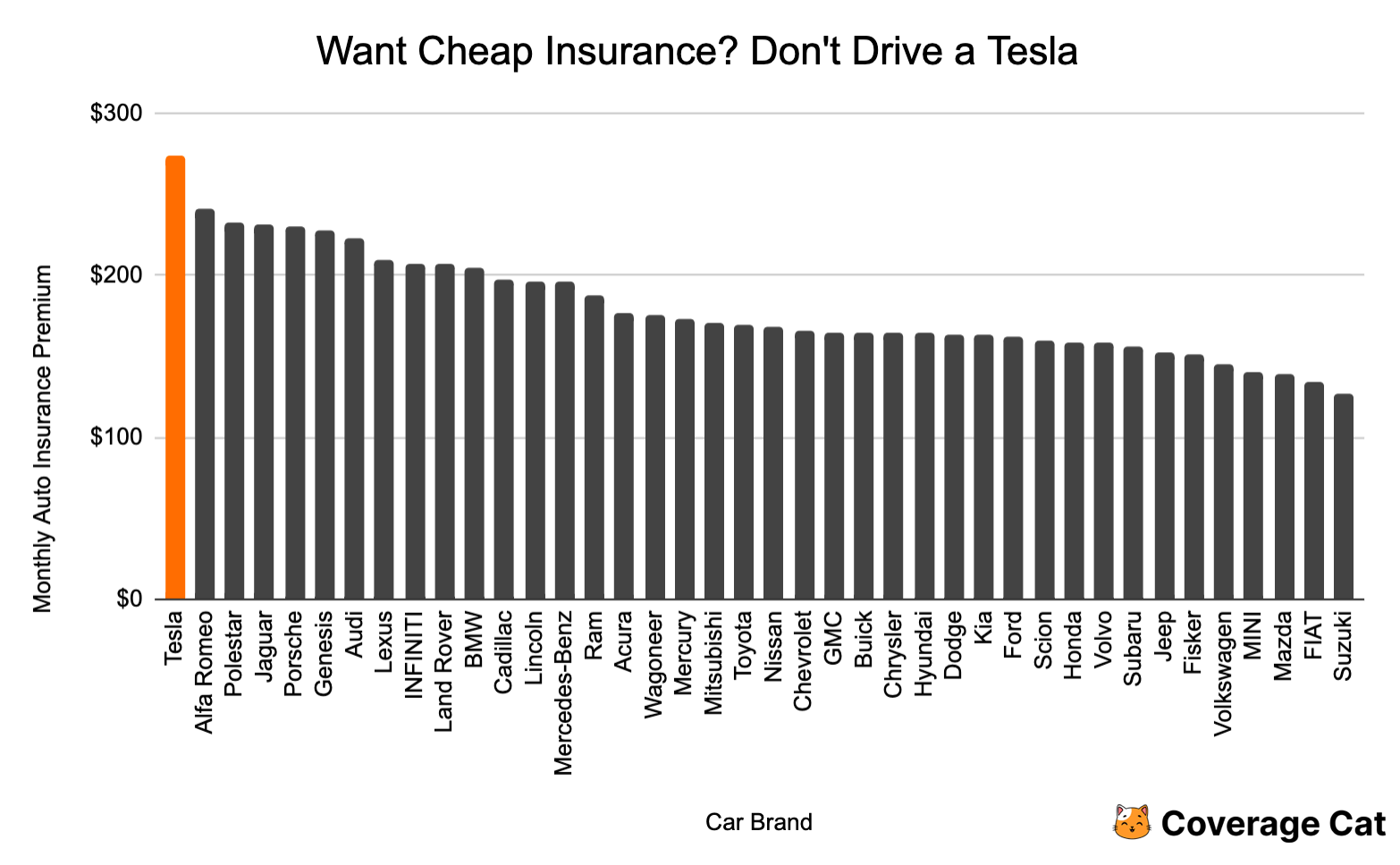

Coverage Cat generated 700,000 car insurance quotes to show why some insurers refuse to cover Kias and Hyundais.

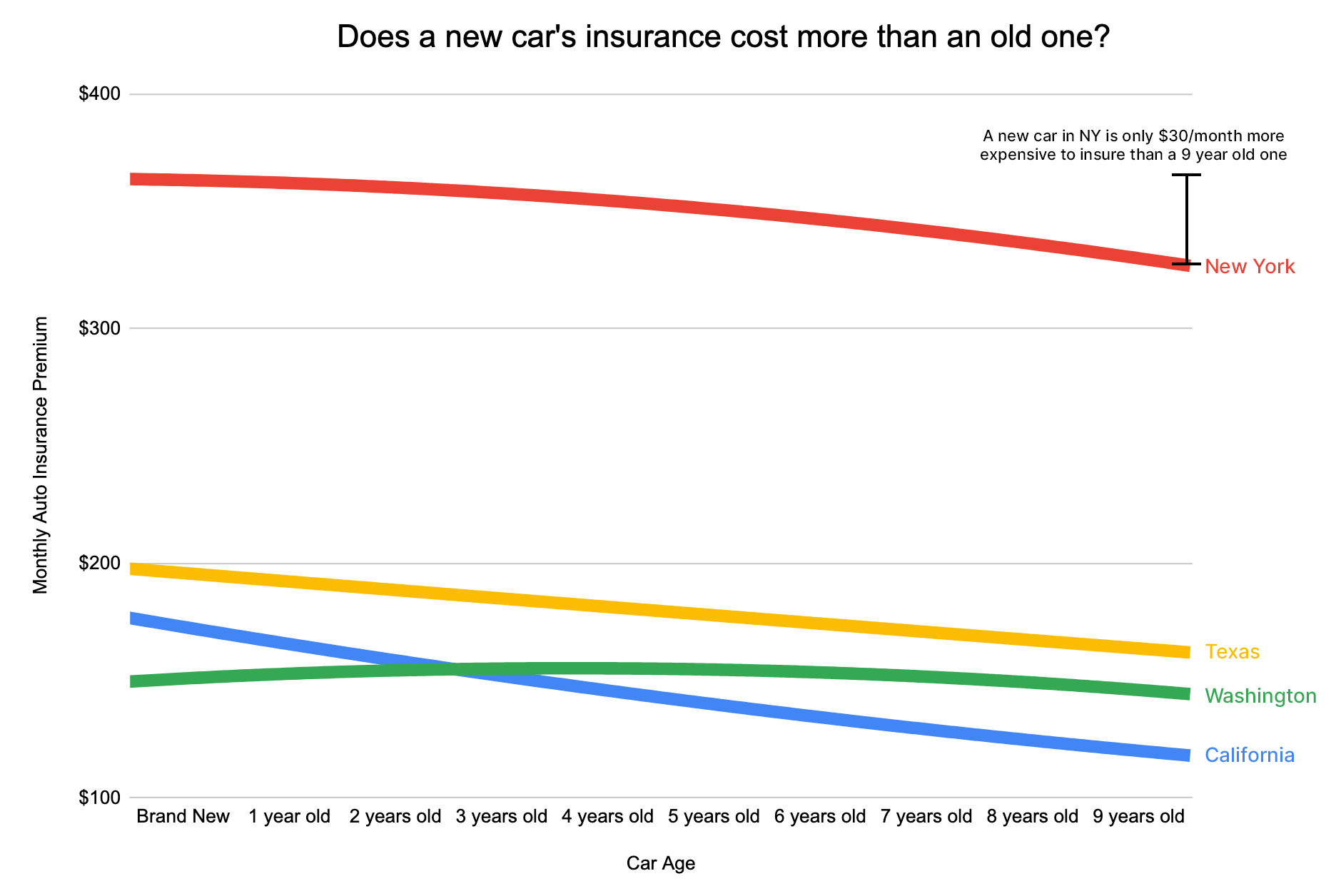

Does your insurance actually go down as your car ages? Coverage Cat built a database of thousands of quotes to find out.

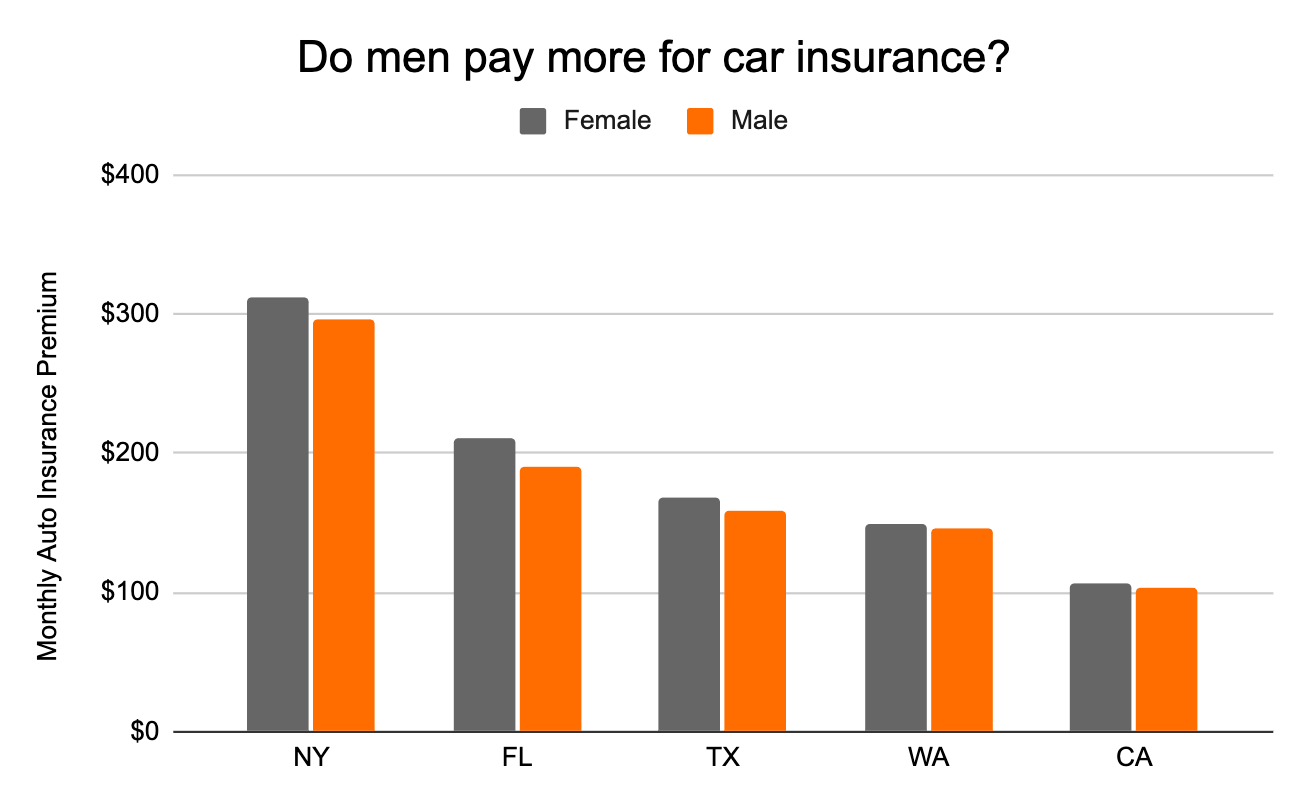

Who really pays more for car insurance? Our analysis of more than 50,000 quotes showed one gender is paying higher premiums in Florida, New York, Texas, and Washington.

Buying homeowners insurance is full of guesswork. How do you pick the right type of insurance to keep from overpaying or risking your home?

Some people don't believe in insurance. For good savers so do we since, broadly, you shouldn't insure anything you can afford to replace.

How much is your privacy worth? Telematics is car insurance that monitors a person's driving habits. Monitoring includes how far, how fast, and how often they brake or accelerate when they drive. It's supposed to lower insurance premiums for some drivers based on their specific behaviors.

Some quality Toks for you to chew on as you face 2023

Something to pay attention to when you clear about $2 million in assets

Oh the times they are a changing. It's now possible to buy complex consumer financial products without talking to a person. What have we wrought?

Or: Trail of cat crumbs. Can you find the 35 cats we created with niijourney?

Your driving and insurance claim history aren’t the only things affecting your premiums. Learning how insurance works and what you’re buying is one of the best ways to get better insurance.

Renters insurance gave me financial superpowers I didn't know about.

The truth is that you aren't getting a deal: instead, your insurance is now worthless because if disaster strikes, your insurer will deny your claim due to fraud.

Often, people believe in myths and misconceptions about the insurance purchasing process. This one's a doozy.

If you find yourself drawn to online calculators or forecasting widgets like DQYDJ or SmartAsset, then this article is for you.

For every $10,000 you spend on insurance premiums, you pay $3,000 in “fees.” Let that sink in.

To cold hard calculators, Google's life insurance "perk" stands out as a perk that just costs you money.

A surprising number of our users are proficient equities traders who fail to apply the rigorous thinking they use for stocks to insurance.

Some insurers pride themselves on a user-friendly and fast experience for buyers, but often use dark design to con users into overbuying coverage.