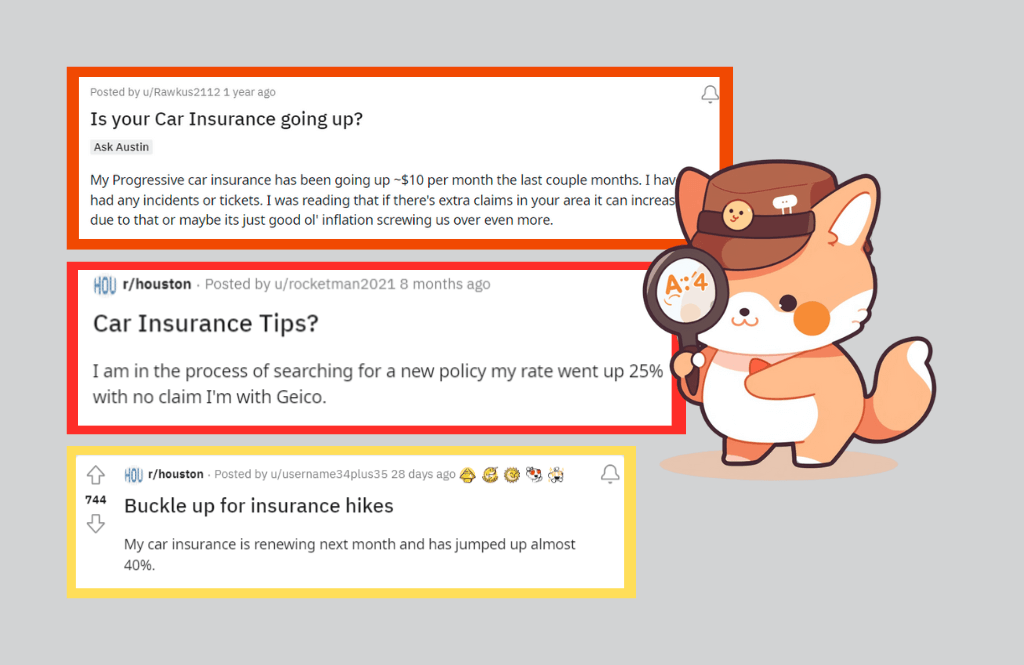

Advice on Reddit can be hit or miss. For every incredible Reddit discovery, there are hundreds of users just speaking from personal experience and no actual expertise.

While we love some Reddit advice – check out our top ten tips from Reddit – other pieces of wisdom are less impressive.

We picked out a few of our favorite examples of bad advice you can find on the site and our alternate recommendations)!

Try to negotiate with your car insurance company

Negotiating with your ISP or for a car is expected. Most insurance companies, however, don’t really care if you get a lower price elsewhere. They’ve usually rated you for your specific price and, while you can adjust your insurance coverages to get a lower premium - they can’t always “price-match”.

Coverage Cats advice

Shop around anyway and, if you’ve found lower prices, it doesn’t hurt to ask your car insurance company if there’s anything they can do for you. Some companies force you get on the phone anyway when you cancel. Just be prepared to switch! If you’re offered a lower price, make sure your coverages still protect you. Getting a lower price because you lowered your bodily injury or property damage limits means you’re getting less insurance for a lower price (which isn’t really a deal).

Get married to lower your car insurance premium

While all of this advice is technically true, it’s not going to help most people save on their car insurance. Getting married, being older, and insuring an older car can drive down your premiums but most people don’t fashion their lives around being a better car insurance customer. We definitely wouldn't recommend it!

Plus, the average cost of a wedding in 2020 was more than $20,000 – definitely not worth saving even a few hundred dollars on your premium.

Coverage Cats advice

Instead of trying to figure out ways that are irrelevant to your pricing, look into material changes you can make to your policy. Make sure you don’t let your insurance lapse, raise your deductibles if you can afford it, drop coverages that you don’t actually need–such as towing and rental reimbursement–, and try to shop for new insurance early. Most importantly, always shop around, especially if you do get married, buy a new car, or move!

Lie about your annual mileage (and get denied for coverage later)

When you’re reporting your annual mileage, insurance companies know that you’re estimating. They can’t penalize you for being a little off and they know that, as long as you’re in the ballpark, they’ll have customers who fall under and over their estimated mileage every year. But the average US driver has an annual mileage of about 13,000. If you’re lying about the amount you drive this significantly, you might get a big discount, but you’re also in huge danger if you get into a crash. A lie like this can constitute “material misrepresentation” meaning that your insurance company can deny your claim and revoke your coverage.

Coverage Cats advice

Don’t be afraid to give your best guess on mileage, and know that you can always update your insurance company if your circumstances change (you stop driving as much, or start a longer commute). Plus, there might be way more insurance discounts you qualify for. Most companies reward you for bundling and being accident-free, but you might also get alumni discounts, or preferred rates for being in certain industries, having a AAA membership, or using their telematics program to track your driving. We recommend all of these to get lower prices, without risking your coverage.

Reviewed by

Max Cho

, Licensed Insurance Broker NPN 20377411

Just buy from my insurance company!

When a user went on r/lasvegaslocals to get some advice after their insurance was canceled, u/cajunsamurai had this advice to offer:

This isn’t actually bad advice – it’s just typical for Reddit. Most people can only offer their personal experiences, and one person’s cheapest insurance could be another person’s worst price.

Coverage Cats advice

Shopping around is one of the best ways to get a lower price. That’s in part because you just don’t know who will give you the best price, and the company that gives you the best price could change as you move, age, get a new car, or add drivers to your policy. Geico, Progressive, Travelers, and every other insurance company use a complex set of rating variables to determine your individual price. You might have a significantly worse rating than u/CajunSamurai does at Geico - but be a great fit for another insurance company. So, try Geico or whatever company your friend/neighbor/dad tells you is “the absolute cheapest” but make sure you check 2-3 more companies to check how they compare.

Lie about your garaging address for cheaper rates (and get your policy canceled for fraud).

We don’t recommend doing anything you find on r/IllegalLifeProTips, but u/Salty-Photo-57’s advice for lowering your rates is especially bad. Lying about your garaging address might save you some dollars up front, but it’s also likely to get your claims denied, your policy canceled, and you could even be charged with insurance fraud!

Coverage Cats advice

While the advice on r/IllegalLifeProTips is clearly a joke, it’s great to remember that Reddit is full of joke-oriented spaces and following some advice on the site could lead to terrible (and illegal) outcomes.

Before you post asking for car insurance advice on Reddit, make sure you avoid bad advice by: 1. Picking the subreddit you use carefully. Instead of just posting in every subreddit you follow, try searching around for spaces where you might find experts. Your local city’s subreddit can be great for local insurance broker recommendations, but if you want information on car insurance stick to r/insurance or r/ Car_Insurance_Help, and if you’re interested in financial advice you could try r/personalfinance and r/frugal.

- Use the serious tag when it’s available. Some subreddits love a good joke pile-on, but if you need actual advice see if you can add the [serious] tag to your post’s title. For some subreddits, this can be a great way for mods to remove joke responses and it tells posters what you need.

- Take what people comment with a grain of salt. It’s easy to say you’re an expert online, and Reddit is no exception.

- Remember that what works for someone else might not work for you. Getting a lot of personal advice is overwhelming and can waste a lot of your time. Know that some people’s advice only works in their state/for their circumstances/with their insurer and if you have questions, ask an actual insurance professional.