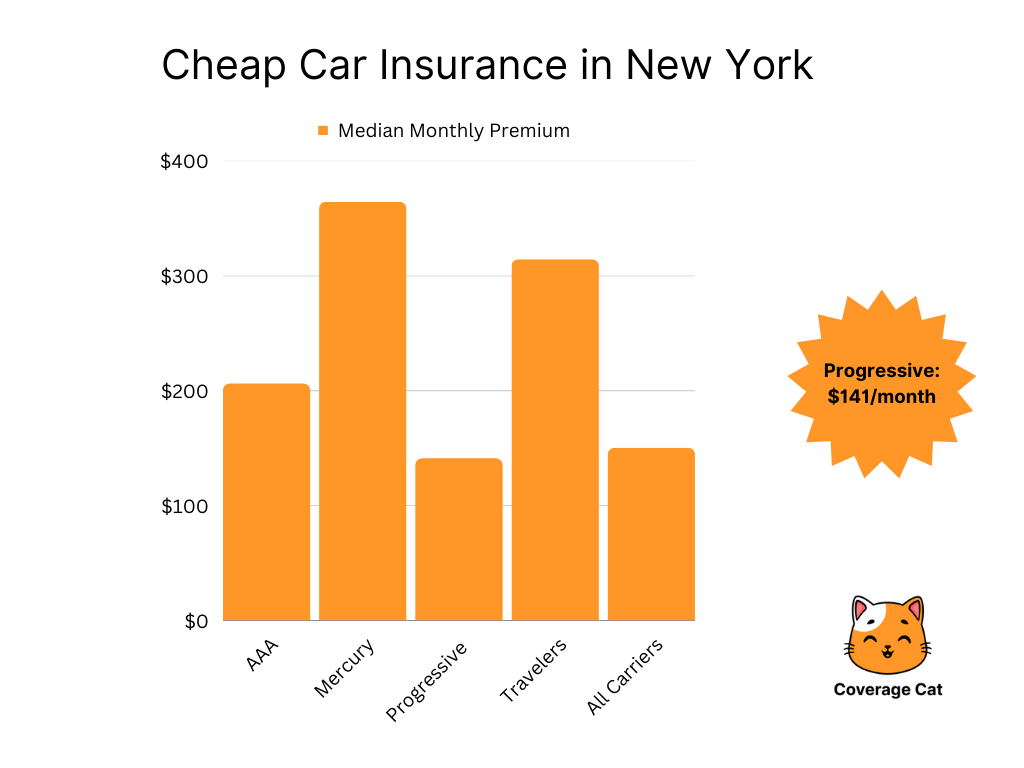

Progressive has the best cheap car insurance in New York

Coverage Cat found that Progressive has the best cheap car insurance, with premiums of approximately $141 per month. The median New Yorker pays $150 per month for car insurance, or $1,800 yearly, while the median New Yorker with a Progressive policy is paying only $1,692 yearly, saving them approximately $108 a year.

Carrier

AAA

Mercury

Progressive

Travelers

Median Monthly Premium

$206

$364

$141

$314

Why you should trust us

I first started navigating insurance and efficiently finding out how to use it and buy it more than 15 years ago, when an injury left me missing two teeth. That experience inspired me to start Coverage Cat, as a way for people to discover transparent price data about their insurance and make better choices with that information. I want to help all Americans avoid overpaying for expensive insurance they don't need and get the right coverage at the right price.

Before founding Coverage Cat and becoming a licensed insurance agent, I spent the past ten years working in quantitative roles at Google, Two Sigma, and Microsoft.

Methodology

To determine our top picks, Coverage Cat generated a unique database of over 53,000 quotes for New York drivers. Within this dataset, we represented drivers from ages 16-70, driving vehicles that were up to 15 years old, and from a variety of makes. Using thousands of quotes, we’re able to normalize our data and provide a median of randomly generated New York drivers. Internally, we use this dataset and others to match Coverage Cat users with the best insurance for their needs.

Our dataset is continuously adjusted and presented to you in real time. Specific numbers in this article may vary slightly from the latest data contained in the graphs above.

Who is this for

You need car insurance if you're the owner of a car. By law, cars in New York require a minimum amount of insurance coverage. You may also need car insurance if you regularly rent or borrow cars, since it can be both cheaper and provide more security to have a non-owner policy that will cover your liability.

We prepared this data and wrote this guide for people trying to make smart money choices with data. Figuring out the best deal in car insurance isn't easy, since prices and eligibility can vary substantially across individuals.

Cheapest car insurance quotes for young New York drivers

Coverage Cat found that Progressive had the lowest premiums for young New York drivers, aged 20-30, with premiums of approximately $151/month. For younger drivers, particularly those under 25, insurance rates can be significantly higher due to a higher risk of accidents. The median New Yorker aged 20-30 pays $163 per month for car insurance ($1,956/year) and purchasing a cheaper Progressive policy can save them $144/year.

Carrier

Mercury

Progressive

Travelers

Median Monthly Premium

$365

$151

$316

Cheapest car insurance in New York for female drivers

For female drivers in New York, the lowest median monthly premiums were available at Progressive for $153/month. Coverage Cat found that female drivers in New York pay slightly more than male drivers, with a median payment of $162/month. While that’s only $18 more a month than male drivers in New York, that adds up to $216 more every year!

Carrier

Mercury

Progressive

Travelers

Median Monthly Premium

$394

$153

$309

Cheapest car insurance in New York for male drivers

For male drivers in New York, the best cheap car insurance quotes were at Progressive for $136/month. The median cost for male drivers was only slightly higher at $144/month, but the most expensive carrier (Mercury) cost $2,508 more per year than Progressive.

Carrier

Mercury

Progressive

Travelers

Median Monthly Premium

$345

$136

$322

Cheapest car insurance for teen drivers

Coverage Cat found that teen drivers in New York, aged 16-20, pay significantly more on average with premiums of approximately $350/month. Teen drivers are the most likely to be involved in an accident than all other age groups and, as a result, insurance companies charge significantly more for these drivers.

How can you lower car insurance rates for teen drivers?

Teen drivers pay significantly higher premiums on their own policies, $2,400 more a year than the average New York driver. Parents of teen drivers can usually save money adding them to an existing policy, rather than teens purchasing their own insurance policy. You can also take advantage of potential discounts by reporting safety features on your vehicles, such as anti-theft devices and blind-spot detection systems. Teen drivers can also earn their own discounts if they receive high academic grades or enroll in safe driving telematics programs which monitor their driving habits.

Minimum required insurance in New York

In New York, the minimum liability car insurance required by law is 25/50/10. This means $25,000 in bodily injury liability coverage per person, and $50,000 in total bodily injury coverage per accident, as well as $10,000 in property damage liability coverage. Bodily injury liability pays for medical costs and other expenses for the other driver or their passengers when you’ve been in an accident, while property damage covers repairs to other vehicles and/or someone else’s physical structures such as fences or walls.

While minimum liability policies can offer lower premiums, they can also fail to fully cover the cost of damages or injuries in an accident. A crash with expensive vehicles or where another driver is severely injured can easily end up costing much more than the limits of a minimum liability policy. If this happens, your insurance company is only obligated to pay up to their limit and you will be liable for additional costs.

New York car insurance after an accident or ticket

After you’ve been in an accident or received a ticket in New York, your car insurance premium may increase, as these events make drivers an increased risk for insurance companies. The exact impact on your premium will depend on factors like the severity of the accident, the type of ticket you received, and your driving record.

If you were at fault in an accident, your insurance company can raise your premium to cover the costs of the claim, and if the ticket was for a serious violation, such as reckless driving or DUI, your insurance premium could increase significantly, and your company can even choose not to renew your policy.

Frequently Asked Questions

Q: Is insurance expensive in New York?

A: New York auto insurance is more expensive than the national average. The National Association of Insurance Commissioners (NAIC) estimates that New York drivers paid 29% more in premiums than drivers nationwide. The NAIC’s 2019 Auto Insurance Database Report estimates that the average monthly premium for auto insurance was $100 in the U.S., and $129 in New York. New York’s average premium is also more expensive than those in 47 states, with the exception of Louisiana and Michigan.

Q: Which company has the cheapest insurance in New York?

A: According to Coverage Cat, Progressive has the best cheap car insurance in New York with premiums of approximately $141/month, which is lower than the median cost of $150/month. Depending on your insurance needs, however, your insurance could be cheaper (and better) with a different company.

Q: How do I lower my car insurance premiums in New York?

A: While Coverage Cat found that premiums were lower for Progressive drivers overall, switching to one company doesn’t guarantee savings. We recommend shopping for insurance at least every two years, getting multiple quotes, and re-evaluating your insurance needs every time. If that sounds complicated, try out Coverage Cat . We optimize your insurance to serve your needs at the best price.

Editorial Note

The content of this article is based on the author’s opinions and recommendations alone. It has not been previewed, paid for, commissioned or otherwise endorsed by any of our partners.

Coverage Cat’s analysis used insurance rate information derived from our own datasets. These rates were publicly sourced and should be used for informational purposes only. Your own quotes may be different.