Gambler in the Sheets

The past few years have democratized savvy financial moves for millions of Americans, many trading for the first time via platforms like Schwab, Robinhood, or We-Bull. Even as these do-it-yourself investors have taken full advantage of more sophisticated financial stratagems to mitigate their risk, many still neglect the thousands of dollars a year they waste on insurance.

Investing and insurance are two sides of the same coin: how much do you want to risk, how much do you have to cover an emergency? But most people thoughtlessly buy an off-the-shelf policy from a gecko or chatty spokesperson’s ads that ends up costing them down the line. This leads to a situation where most of the customers we speak to are, confusingly, simultaneously over- and under-insured.

Mitch (Not his real name)

The stories here are an amalgam of conversations with users, but we’ll call this bundle of insurance problems Mitch for convenience. Mitch has a disciplined risk approach for his stock trades. He makes liberal use of call options, both long and short, to hedge risk and make sure that he never loses more than he can afford to on a given trade either with or against the price of his underlying stock.

We were impressed by his financial sophistication upfront during our interview and, In our minds, this signaled that he’d behave like a sophisticated insurance buyer– one that uses financial instruments to appropriately mitigate risk.

But, when we started asking Mitch about the insurance he carried it became clear that this was NOT the case.

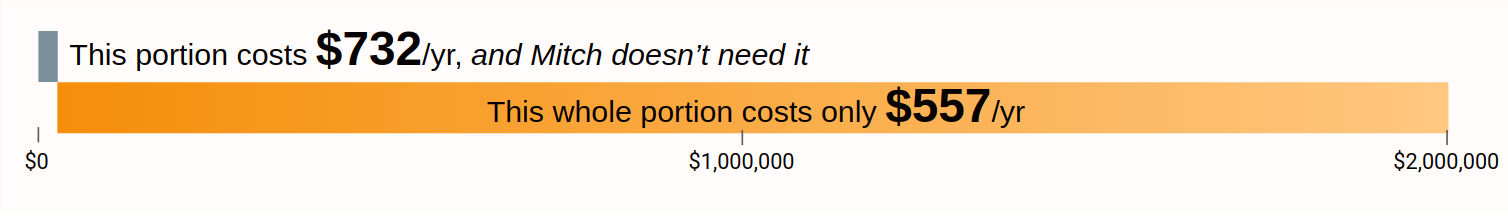

The least egregious errors were that Mitch was insuring for a number of things that he could afford to pay for out of pocket. These objects, like his computer, cellphone, and TV were mostly covered by his renters insurance. He was effectively paying an unnecessary risk premium — not unlike the premium he paid to hedge with options — to cover risks that he simply did not need to insure.

His insurance was effectively taking money out of his pocket, charging him a fee for holding it, and returning it back to Mitch even for insurance events that could have easily been paid out of his bank account.

No insurance in the streets!

More appalling was that Mitch’s insurance also left him dangerously under-insured from truly rare but catastrophic events — the very thing insurance is supposed to solve!

Mitch’s auto insurance only covered the first $30,000; any wreck where she caused more than $30,000 would immediately exhaust his insurance and then consume his own hard earned cash.

3% of American drivers annually are involved in major property damage or serious injuries or death, and any of those incidents would likely cost Mitch hundreds of thousands or millions of dollars, immediately bankrupting him.

Reviewed by

Max Cho

, Licensed Insurance Broker NPN 20377411