Would you pay $500 to place a bet that pays $500,000 if you died this year?

Google employees get a life insurance policy "benefit" that pays out 3x salary in the event of death. Unlike many fringe benefits, the IRS considers this one taxable income. It's on a sliding price scale by age, and can't be opted out of. For a Googler in their 20s or 30s, this comes out to around $450/year in additional income, taxed at the marginal rate, costing most employees around $200 a year.

So, is it worth it for most folks? Let's calculate the expected value for a median Google employee (a 29 year old male):

What you get 1. Likelihood of death in 1 year = [0.001734%]

- Multiplied by the total payout ( median $166k/yr salary ) = $500,000

The insurance's expected value is $867. Or is it? College education correlates with 1/3rd the mortality in the United States ( Table I-7 ). So let's adjust for that, since most Google employees have had at least some college education. 1. Divided by the 3.5x lower likelihood of death among college educated Americans = $247

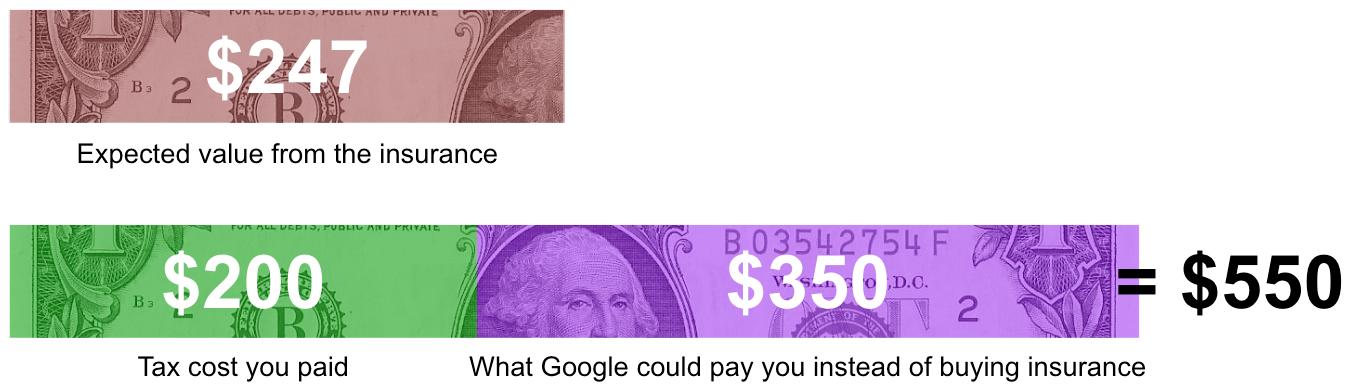

Total expected value from the insurance: $247

What it costs you 1. The tax cost paid by the employee = $200 (additional tax)

- Google paid the insurer $450; without the policy, that cash could be directly paid to the employee = $350 (post-tax)

Total cost for the insurance: $550

****

So now you could either have $550 cash, or an expected value $247 payout from insurance. At Google's roughly 100,000 employees in the United States, that's a net "waste" of $30,000,000 a year.

Just buy it yourself

Even if we aim to be charitable to the insurance’s goals — insulating people from low probability events — the math still doesn't work out. If you're an employee who needs life insurance for money after the unexpected event of your death, I have a much better solution than Google's perk: just go buy it yourself with the $550 extra in your pocket. GEICO will happily sell you a no-medical-exam-needed $500,000 policy for $156/year, leaving you with an extra $394 in cold hard cash to spend on your last year on Earth.

Reviewed by

Max Cho

, Licensed Insurance Broker NPN 20377411