What is a house hack?

House hacking refers to a variety of strategies to generate additional income from your primary residence. This includes buying a duplex and living in one half while renting out the other, renting out a spare room in your single-family house, renting out a separate structure such as detached garage or accessory dwelling unit (ADU), or even renting a part of your property, such as a basement or driveway, for storage.

What are the benefits of house hacking?

House hacking always involves the use of your primary residence. Therefore, when you’re purchasing property, you qualify for a wider variety of financing such as FHA or VA loans, which typically have lower interest rates. For new real-estate investors, it can also be easier to manage rental properties when you’re close by or starting with a smaller challenge like renting a room or driveway. Finally, the “hack” you’re executing has a lot to do with the fact that your income increases with less effort relative to traditional real estate investing. You need housing anyway, and finding ways to lower your housing costs or increase your return on your investment are all benefits of a house hack. It’s no wonder then, that the practice is particularly popular in Financial Independence (FI) or FIRE groups, to optimize their incomes and investments!

Why does insurance matter for house hackers?

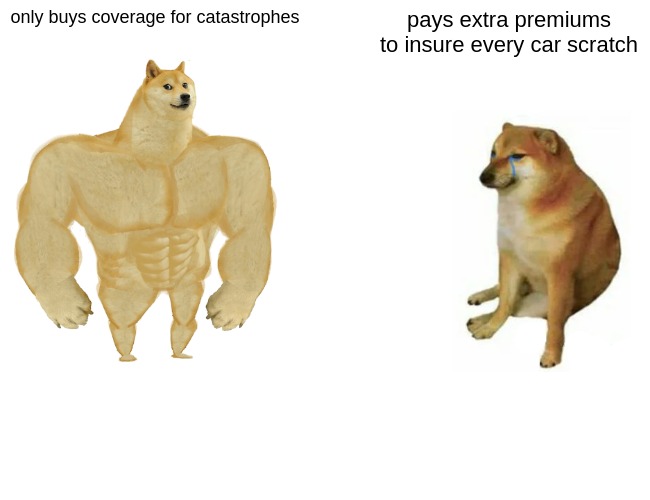

Unlike car insurance, homeowners and landlord insurance aren’t required in any state. So why bother with insuring your property if you’re trying to increase your ROI? The simplest answer is that you still might be required to carry insurance by a mortgage lender, to protect their investment. But, even if you’re not, it’s important to protect your own investment if you couldn’t afford to rebuild from scratch or pay out a massive lawsuit if someone slipped and fell on your property. A house hack can also convert your home into a rental property, meaning that your insurance needs get more complex!

Reviewed by

Max Cho

, Licensed Insurance Broker NPN 20377411

How do you buy the right insurance for your home hack? 1. Determine your appropriate policy type. Your primary residence is typically covered by homeowners insurance, usually called an HO-3 policy, while properties you rent out usually need landlord insurance, also called DP-3 or dwelling fire policies. When your property is both your primary residence and a rental, however, insurance gets more complicated. Whether you qualify for HO-3 or DP-3 policies depends on the insurer, your state, and the specifics of your house hack. If you’re not sure, reach out to a qualified broker like Coverage Cat to figure out your insurance options.

- Know your coverage options. Depending on the type of policy you buy and your house hacking strategy you could benefit from upgrading different coverages. If you're building an ADU, or renting out a detached garage for storage, you could benefit from higher Coverage B on a traditional homeowners policy. If you're buying a landlord policy on a multi-family home, however, making sure you have enough "loss of use" or "rental coverage" can provide additional protection if costly repairs temporarily cost you rental income.

- Carefully consider your add-ons. Insurance companies usually offer a variety of "riders" or "endorsements" as policy add-ons. When you're a house hacker, it's even more important to review these options, as some can be highly impactful for your situation. Landlord insurance, for example, doesn't typically cover any of the property inside your house, like furniture and electronics, but if your strategy is renting out a furnished apartment to traveling professionals adding a rider to incorporate those furnishings can make rebuilding your investment property easier.

- Get umbrella insurance. Whether you're just starting a house hack or already have a few properties, umbrella insurance can be a worthy addition to your insurance portfolio. Umbrella insurance protects you in case you exhaust the limits on your other policies (homeowners, landlord, renters, auto, even watercraft), and usually starts at $1 million in additional coverage for only a few hundred dollars more per year. Umbrella policies protect you in a wide range of situations, from a tenant getting injured on your property, car crashes where someone in your household is responsible for significant damage, and even libel or slander suits which aren’t usually covered by personal insurance. For house hackers who expand into further properties, umbrella insurance is also beneficial as it can cover multiple properties across various states, and you can easily increase your coverage as your assets grow.

Looking for more tools? We recommend Walletburst’s House Hacking Calculator for FIRE enthusiasts and, of course, using Coverage Cat to optimize your insurance.