Do I really need renters insurance?

Even if you’re not required to purchase renters insurance, we’d recommend buying a policy for a few reasons. If you’re unable to or willing to re-purchase everything you own in the event of a disaster like a massive theft or a fire in your building, renters insurance protects against paying those out-of-pocket costs. And if you’ve saved enough to afford large-scale costs like replacing everything you own, renters insurance provides additional asset protection. If someone gets injured in your home or is hurt by you or a pet (even outside your home), renters insurance protects against lawsuits and settlements.

How do I lower my premiums?

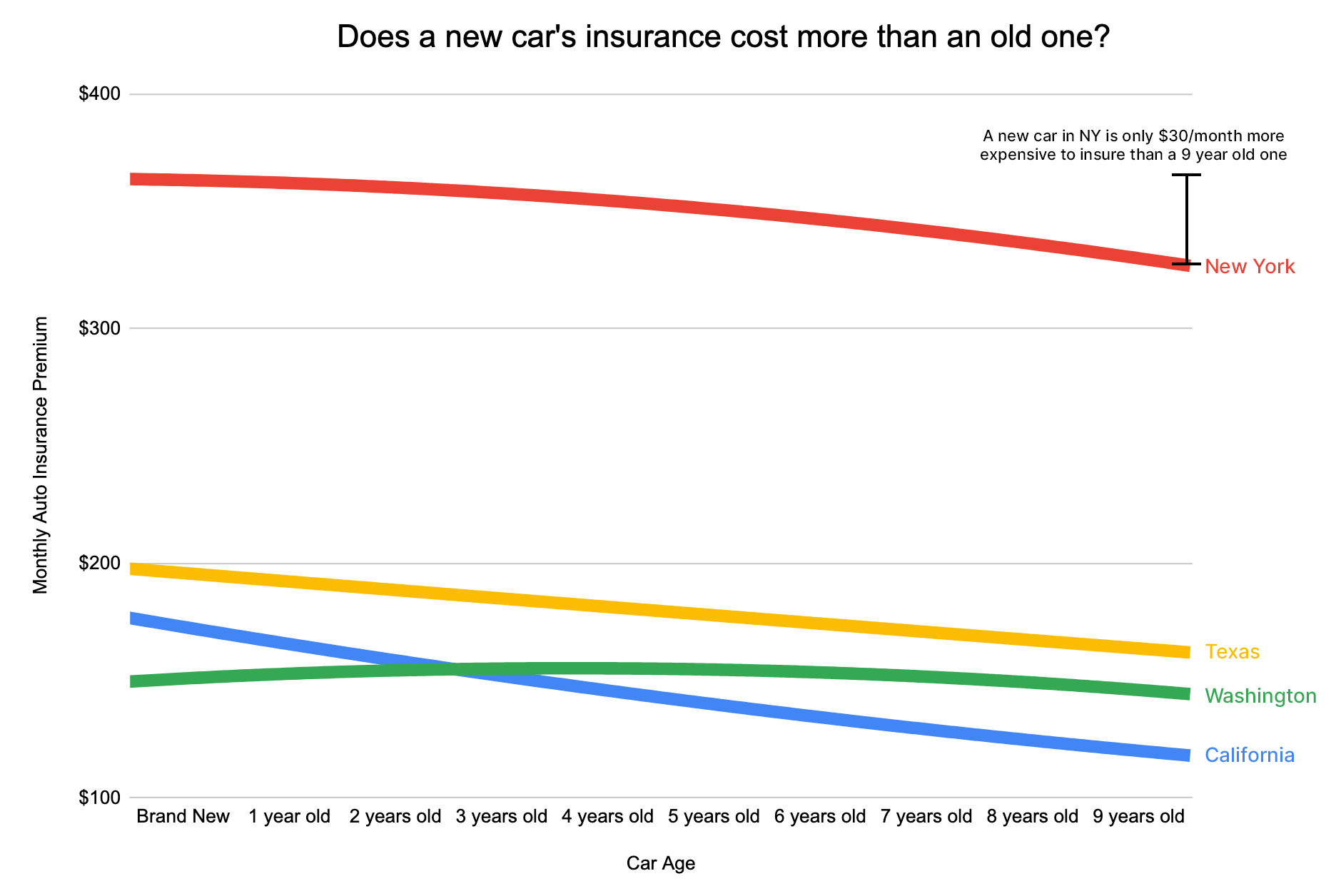

First, make sure you’re taking advantage of easy-to-acquire discounts. Bundling policies, reporting safety features like fire extinguishers or deadbolts, or even paying in full can produce easy savings in a new or existing policy. Second, raise your deductible if you can afford it. If you can pay for smaller expenses out-of-pocket, like replacing a stolen laptop, you can save on premiums with a higher deductible and keep your insurance rates low by not filing small claims. Finally, make sure you shop around whenever you move or approximately every year. Renter’s insurance rates are determined by zip code and specific to your location; therefore, your best options might change as you move (particularly if you move across state lines).

How much renters insurance do I need?

This depends primarily on two factors; how much you own and your net worth. It’s important to document how much your belongings are worth and adjust your insurance accordingly. You need much more coverage if you’ve outfitted your apartment with high value-furnishings than if you have minimal belongings. Just remember to read the fine print as most policies have limits (often around $1,500) for specific types of personal property like electronics and jewelry, so you’ll either need to purchase additional coverage or have them covered by a separate insurance policy. The other factor, your net worth, helps determine how much liability protection you need. If you have a higher net worth or earning potential, a higher liability limit will protect your current savings and future earnings from lawsuits. Does that sound a little complicated? Then try out Coverage Cat to simplify your renters insurance buying!

How to Understand your Renters Insurance Policy

Luckily, renters insurance is relatively easy to understand compared to other policies. That’s because a renters policy (also called an HO-6) is limited in its coverage. Unlike a homeowners policy which insures the structure of a building, or an auto policy that protects against many different types of damage to your car, a renters policy covers a more limited range of events and property. Below you’ll find the top terms you need to understand your policy, whether you’re reviewing your current plan or shopping for new options.

Personal Property: This coverage insures items inside your home, such as furniture, electronics, and clothing, and provides you with the cost of replacing your belongings if they’re stolen or damaged.

Loss of Use/Additional living expenses: If you cannot live in your home due to a covered loss, such as a fire, this coverage will help pay for additional living expenses like temporary housing, hotel stays, pet boarding, and additional food expenses. If you live in a high-cost-of-living area, this coverage can be beneficial for ensuring a temporary loss of housing doesn’t seriously affect your income or savings.

Personal Liability: If someone is injured on your property or by you or a pet (even outside your home) and the other party decides to sue you to pay for medical costs or loss of income, personal liability coverage pays for legal fees and any settlements against you. Often overlooked, it’s essential to make sure you’re adjusting this coverage to help protect your assets in case of a lawsuit.

Deductibles: The amount you’ll need to pay before your coverage begins. For example, a $1,000 deductible means that a claim of $5,000 would give you an insurance payment of $4,000. Raising your deductible can usually save you on premium costs if you can afford to pay for smaller events out-of-pocket.

Endorsements or riders: These are additional options you can add to your policy that will provide extra coverage in certain situations. Sinkhole or earthquake endorsements, for example, increase the events you’re protected from, as your insurance does not usually cover these specific natural disasters. Other endorsements extend how much your insurance covers particular items, such as electronic equipment or jewelry. Most policies have a specific limit for how much they’ll pay for these categories (usually between $1,000-$2,000); therefore, they allow you to individually raise those limits if you want your insurance to pay out for a higher amount of that item.