Types of Insurance / Homeowners Insurance / Cancellations and Nonrenewal

Homeowners Endorsements and Riders

Endorsements and riders can customize your homeowners policy to create your best coverage, but they can also raise your rates if you're not careful. Before buying, figure out what you need and what's actually covered.

**** Homeowners insurance doesn’t cover every possible scenario, and depending on what you own, where you live, and what you need, you might need to customize your policy. Insurance endorsements and riders are optional additions to your policy that change your coverage. Often, endorsements increase your coverage without you needing to buy a standalone policy, but some endorsements can decrease coverage you don’t need and lower your premiums.

Key Takeaways

Endorsements customize your policy

Insurance isn't one-size-fits-all. Use the right endorsements & riders to make your protection stronger.

The best endorsements cover the biggest risks

Extra insurance should protect you from the most financially devastating even ts—lik e having to rebuild your entire house.

The right endorsements for you depend on your home

Buying more insurance isn't always worth the cost. The best endorsements for you depend on your home, the area you live in, and what you own

What is the difference between a rider and an endorsement?

Insurance riders and endorsements are used interchangeably, depending on the insurance company and policy type. All endorsements/riders essentially do the same thing – they customize some aspect of your policy by either including, excluding, or modifying coverage.

Common Types of Endorsements and Riders

There are a huge number of endorsements and riders, and they can be a great way to customize your coverage, get better protection, or even save money. But which ones are worth the money, and what do they all mean? We’ll dive into some of the most common endorsements/riders to help you pick the right ones for your customized policy.

Extended Replacement Cost

Extended Replacement Cost Coverage is an endorsement customizing your Coverage A. It adds a certain percentage of your Coverage A, up to 100%, if repairs end up costing more than your estimated Replacement Cost. Example, if your dwelling coverage is $200,000 and you purchase 50% in Extended Replacement Cost Coverage ($100,000), you can access up to $300,000 total for major repairs or complete replacement of your home.

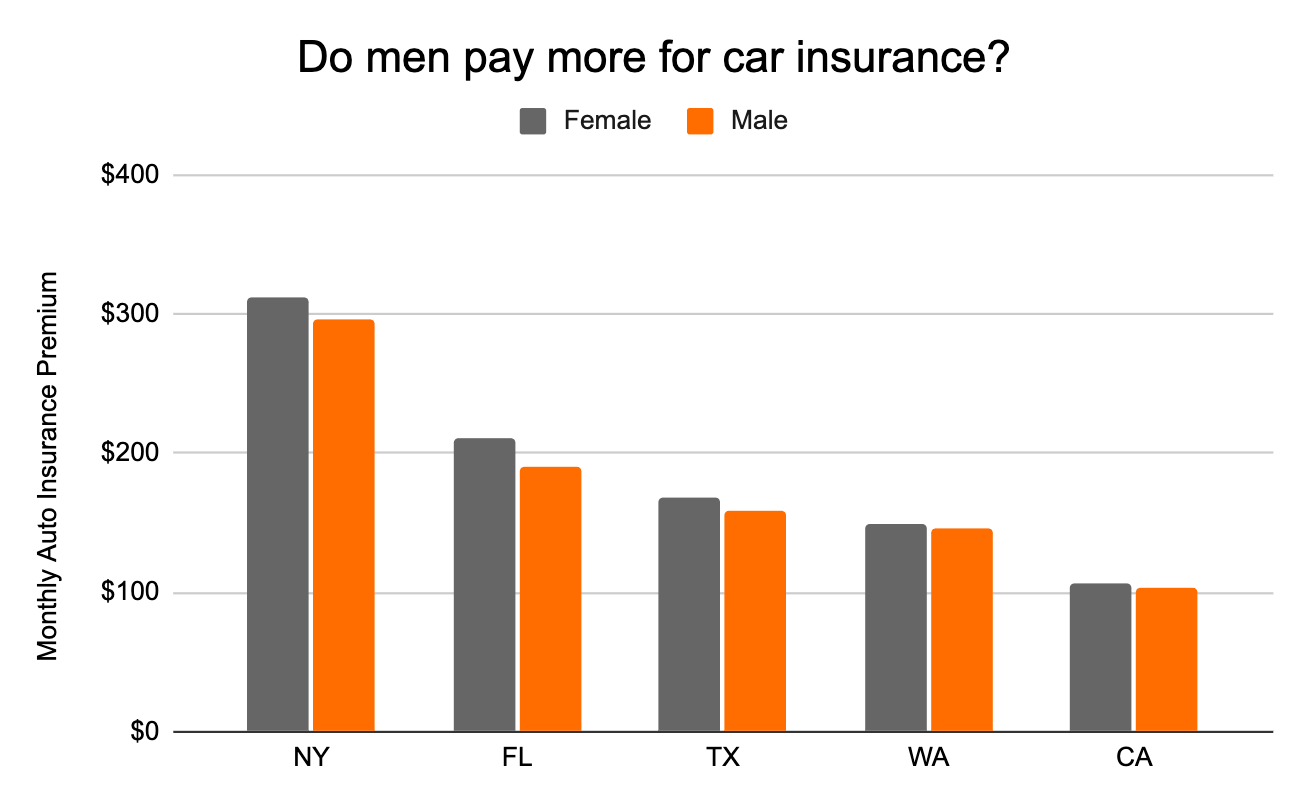

When an insurance company calculates the amount of money it will take to completely rebuild your house after a disaster, they’re just providing an estimate. After a natural disaster, however, material and labor costs can skyrocket and it could cost significantly more to replace your home. Extended Replacement Cost Coverage simply provides a buffer for your Coverage A, and increases your dwelling coverage at a lower cost. If you live in an area where covered natural disasters are common, such as New York, California, Washington, Texas, or Florida – consider Extended Replacement Cost Coverage to strengthen your coverage for less.

Should I buy extended replacement cost coverage?

Extended Replacement Cost Coverage is a popular endorsement because it can provide hundreds of thousands in additional coverage – for less than it would cost to increase your Coverage A by the same amount. It’s also a great option for states or regions where there is a greater risk for natural disasters, as you’re more likely to experience higher building costs when many houses need to be rebuilt at once. For homeowners who want more peace of mind, Extended Replacement Cost Coverage can also assuage any fears that you haven’t purchased enough Coverage A, without significantly increasing your premiums.

Ordinance or law protection

Ordinance or law protection modifies your Coverage A, making it higher in case you’re rebuilding your home and new building codes or laws make it more expensive. Like Extended Replacement Cost Coverage, it is less expensive to add than increasing your Coverage A by the same amount, and it gives you more protection in case your costs end up being higher than predicted. If you’ve ever started a construction project and ended up over budget, it’s easy to see the value of ordinance or law protection.

Should I get ordinance or law protection?

There are a few scenarios where ordinance or law protection are especially helpful; you live in an older home, you haven’t updated your home in a while, or you’re not sure when your home was last updated. In these scenarios, it’s more likely that even rebuilding a part of your home might incur additional cost if you’re required to meet new building code and regulations.

Ordinance and law coverage can also give you better protection if you live in an area with stringent building codes. For example, if a fire only destroyed part of your home, you might live in an area that requires complete demolition and rebuilding if more than half of your home was destroyed. Your insurance, however, would only pay for rebuilding what the fire destroyed. With Ordinance and law coverage, you could access more of your Coverage A and fully rebuild.

Personal Property Replacement Cost

Personal Property Replacement Cost Coverage modifies your existing Coverage C by making sure you’ll be paid for the cost to replace your belongings. Many homeowners insurance policies cover your personal possessions (furniture, appliances, clothing, electronics, etc.) with Actual Cash Value, which allows insurance companies to consider depreciation and damage.

Should I get personal property replacement cost coverage?

If you own older furniture or appliances, you could receive much less than it costs to replace them with new or even used items – especially with inflation! Personal Property Replacement Cost Coverage just ensures that depreciation won’t be factored in. If you need to replace your furniture or kitchen appliances you’ll receive the amount needed to buy new, equivalent models. If you have Actual Cash Value (ACV) coverage, your insurance company will provide a lower payout and you might need to buy used items or pay more out of pocket to refurnish your home.

Water Backup and Sump Pump Overflow

Sump pump overflow and water backup coverage protects your home against damage caused by water backing up through sewers, drains, or a sump pump. Even with proper maintenance, water backups can happen as a result of older sewer systems, heavy rainfall, blockages, your neighbor’s lack of maintenance, and even tree roots. If you experience a backup, it can cause damage to your belongings, your walls, electrical, floors, and more - and none of these damages are covered by homeowners insurance without a water backup endorsement.

Should I get water backup and sump pump overflow coverage?

If you live in an area with heavy rainfall or other water-related issues, getting sump pump overflow and water backup coverage can give you much greater peace of mind. If you have a sump pump and you live in an area at risk of power outages, you can also benefit. Outages that affect your sump pump can lead to water pooling inside your house and create significant damage.

Equipment Breakdown

Also known as mechanical breakdown or machinery insurance, an equipment breakdown endorsement covers you if equipment like your sump pump, boiler, electrical, or heating system breaks down. If you live in an older home, or are buying a home with older mechanical equipment this endorsement can also provide greater protection as you’re more likely to need complete replacement of your systems sooner.

Types of equipment covered by equipment breakdown coverage

The endorsement typically covers a wide range of mechanical and electrical equipment, including but not limited to: - Computers and related equipment

- Electrical panels

- Back-up generators

- Sump pumps

- Boilers and furnaces

- Washers and dryers

- Refrigerators and freezers

- Ovens and microwaves

Scheduled Personal Property

Homeowners insurance covers your stuff, but only up to a certain point. Most policies limit how much they’ll cover very expensive items such as jewelry, cameras, musical instruments, stamps, coins, silverware, fine arts, guns, or furs. A scheduled personal property endorsement lets you pick specific high-value items and provide an agreed upon value that your insurance will cover.

How does a scheduled personal property endorsement change your homeowner's policy?

Agreed Value. Unlike the rest of your personal property coverage, you’re usually required to start coverage with an agreed value for your valuable items. This keeps you from claiming your watch or engagement ring is worth substantially more after they’re destroyed or damaged, and it stops your insurance company from undervaluing your property.

Appraisal or Documentation. You’ll usually need to provide documentation showing the value you want to cover. This could be as simple as submitting a receipt, but for items that have difficult to define value like fine art, collectibles, furs, and antiques you’ll usually need an appraisal or professional valuation.

Specific Coverage. Once your property is covered on your policy, you’ll find that each item you list is individually covered, meaning you can file a claim for each affected item individually. You also might be covered for more situations than the rest of your personal property.

Separate Deductible. Usually, you’ll also have a separate deductible for scheduled items, which is lower than your standard deductible.

Removing items. You can add or remove scheduled items from your policy as needed. This allows you to account for your changing priorities and possessions, but also means you’ll need to manage your policy actively and remember to add or remove items.

Should I buy scheduled personal property coverage?

If you have high-value items, scheduled personal property endorsements can keep you from being underinsured if your home is robbed or burns down. This endorsement is also typically more inexpensive than buying a standalone policy (also called a personal articles floater). A standalone policy, however, doesn’t affect your homeowners insurance premium. While you might save up-front by purchasing an endorsement rather than a personal articles floater, if you file a claim your homeowners insurance premium could increase and some insurance companies can even non-renew your policy after multiple claims.

Earthquake, Flood, Windstorm, and Hail

Homeowners insurance typically covers a variety of perils, but coverage for certain natural disasters, such as earthquakes, floods, and windstorms, may be limited or excluded from standard policies. To address these gaps in coverage, homeowners can often purchase specific endorsements or additional policies tailored to these risks. Here's an overview of endorsements or policies related to each of these natural disasters:

Flood Insurance

Homeowners insurance doesn’t cover flood damage, and there generally aren’t endorsements to add this coverage to your policy. You have to purchase a standalone flood insurance policy either through the National Flood Insurance Program (NFIP) or private insurers. Flood insurance covers damage caused by overflowing rivers, heavy rain, storm surges, and other flood-related events, none of which are covered by a homeowners insurance policy. If you live in a high-risk flood zone, you also might be required to carry flood insurance if you want to buy homeowners insurance.

Earthquake Insurance

Standard homeowners insurance policies do not cover earthquake damage or damage resulting from landslides. To obtain coverage for earthquakes, you might be able to add an earthquake endorsement to your policy or purchase standalone earthquake insurance. Not every insurance company offers this endorsement or standalone earthquake insurance, and some might only offer it in specific states such as California and Washington. If your current insurer doesn’t offer coverage, you can also reach out to your state’s Department of Insurance to see where coverage is offered.

Windstorm and Hail endorsements

You’re typically covered for windstorm and hail events by a standard homeowners insurance policy. In certain states or even zip codes where insurance companies determine you’re at higher risk, you might need to add an endorsement to your policy to get this coverage. If you live in a state or region prone to hail, hurricanes, tornadoes, or other wind-related perils make sure to check your coverage for Windstorm or Hail exclusions. Adding back coverage through an endorsement is likely to be more expensive, but it could also protect you from a more common event.